The Importance of a Tax Depreciation Schedule in Property Investment

Navigating the property investment world requires careful financial planning and strategic decisions. Among the most underutilized tools by property investors is the tax depreciation schedule, a detailed report that unlocks significant tax deductions. By understanding and leveraging depreciation, investors can enhance their returns while complying with Australian Tax Office (ATO) regulations.

Tax depreciation schedules offer financial relief by outlining deductions for the wear and tear of a property and its assets over time. This guide breaks down their mechanics, benefits, and how investors can maximize returns.

Understanding Tax Depreciation

Depreciation refers to the gradual decline in the value of an asset over time. For property investors, this means claiming deductions for the wear and tear on both the building’s structure and its assets.

The Australian Context for Depreciation Claims

In Australia, the ATO recognizes depreciation as a legitimate tax deduction, allowing investors to offset property ownership costs. This is especially beneficial for rental property owners, as deductions can significantly reduce the taxes owed on rental income.

Depreciation Streams in Tax Schedules

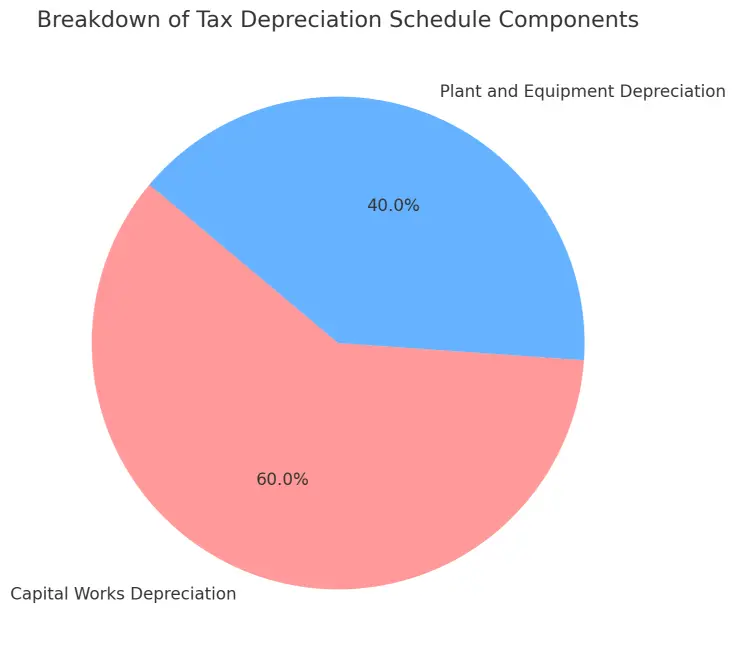

Tax depreciation schedules are built around two primary components: Capital Works Depreciation and Plant and Equipment Depreciation. Each stream targets different aspects of a property’s value, offering unique opportunities for tax savings. Understanding how these components work is essential for maximizing deductions and ensuring compliance with ATO regulations.

Capital Works Depreciation accounts for the structure’s longevity, while Plant and Equipment Depreciation focuses on assets with faster write-offs.

Capital Works Depreciation in Property Taxation

- Definition: Capital works depreciation relates to the building’s structural components, such as walls, roofs, and fixed fixtures.

- Calculation Methodology: Typically calculated at 2.5% per year for properties built after July 1985, with deductions lasting up to 40 years.

- Key Characteristics:

- Applies only to the construction cost, not the land value.

- Requires accurate documentation of construction dates and costs.

- Applies only to the construction cost, not the land value.

- Numerical Example:

A residential property with $400,000 in eligible construction costs yields $10,000 in annual deductions.

Plant and Equipment Depreciation Explained

- Asset Categories: Includes removable items such as appliances, furniture, carpets, and lighting fixtures.

- Depreciation Rates: Assets depreciate faster than capital works components, with rates depending on their effective life as defined by the ATO.

- Comparative Analysis:

For instance, a $3,000 oven might depreciate fully within five years, offering quicker tax benefits than structural components.

Key Difference Between Streams

While capital works depreciation spreads out over decades, plant and equipment depreciation provides faster deductions but is subject to stricter eligibility rules. Properties acquired after May 9, 2017, can only claim deductions for newly installed assets.

Strategic Implications of a Tax Depreciation Schedule

A tax depreciation schedule is not just a compliance document—it’s a strategic tool that can significantly impact your investment’s profitability. By claiming eligible deductions, property investors can improve cash flow, reduce taxable income, and reinvest savings into their portfolios.

Discover why quantity surveyors are vital for cost control in Australian construction. This section explores how depreciation influences financial outcomes and highlights real-world investment scenarios.

Maximizing tax deductions through depreciation directly impacts an investor’s bottom line.

- Financial Impact Analysis:

Claiming depreciation reduces taxable income, providing cash flow that can be reinvested into other properties or projects. - Investment Scenarios:

Consider a rental property generating $30,000 annually in rent. With $12,000 in depreciation deductions, the investor reduces their taxable income, resulting in significant savings. - Potential Tax Savings:

Investors with newer or renovated properties often save thousands annually by fully utilizing a tax depreciation schedule.

To ensure success with tax depreciation, focusing on these foundational pillars is crucial. The infographic below outlines the key elements for maximizing benefits.

Pillars of Tax Depreciation Success: Key elements to ensure compliance, maximize savings, and streamline depreciation claims.

Managing Risks in Tax Depreciation

While tax depreciation schedules offer substantial benefits, improper preparation or documentation can lead to compliance issues and missed deductions. Managing risks involves maintaining accurate records, engaging certified professionals, and adhering to ATO guidelines. This section covers essential strategies to safeguard your claims and maximize their legitimacy.

Ensuring Documentation Integrity for Depreciation Claims

Accurate and comprehensive records are vital. Ensure you retain construction contracts, receipts, and invoices for renovations or new purchases. Without proper documentation, you may miss out on eligible claims or risk non-compliance.

ATO Compliance and the Role of Certified Quantity

Only certified quantity surveyors are authorized to prepare tax depreciation schedules under Australian tax law. Engaging an uncertified preparer could result in rejected claims or audit complications.

Technological Advances in Depreciation Calculations

The world of tax depreciation is evolving, with technology playing a pivotal role in simplifying and enhancing the accuracy of calculations. From AI-powered tools to advanced software solutions, these innovations streamline the preparation of tax depreciation schedules, reduce human error, and provide deeper insights for property investors. This section explores the emerging trends and the future of technology-driven depreciation management.

Emerging Trends in Depreciation

The adoption of technology is streamlining how tax depreciation schedules are created. AI-powered tools and advanced inspection software allow professionals to identify assets and calculate depreciation faster, improving accuracy.

Future Trends in Depreciation for Property Investors

As technology evolves, the integration of digital tools is expected to enhance the precision of depreciation schedules, reduce human error, and provide tailored financial insights for property investors.

Tax Optimization Techniques for Property Investors

Strategically optimizing your depreciation claims ensures that you’re leveraging every possible tax advantage. From timing your deductions during high-income years to updating schedules after renovations, effective techniques can amplify your returns. This section provides actionable tips for making the most of your tax depreciation schedule.

Strategic Claim Timing

Investors can optimize deductions by aligning depreciation claims with high-income years, ensuring the maximum benefit from tax savings.

Renovation Impact Calculations

Adding new assets or renovating a property can increase depreciation claims. Updating your schedule after renovations ensures all eligible deductions are included, enhancing your overall savings.

Frequently Asked Questions

1. Can I claim depreciation on older properties?

Yes. While properties built before July 1985 don’t qualify for capital works deductions, you can still claim depreciation on plant and equipment if they were acquired or installed after this date.

2. How do renovations affect my depreciation schedule?

Renovations significantly impact your schedule by adding new assets eligible for depreciation. Ensure that all renovations are documented, as even work done by previous owners can qualify.

3. What is the cost of preparing a tax depreciation schedule?

The cost varies based on the property’s size and complexity but typically ranges from $500 to $1,000. This expense is often tax-deductible, further reducing your out-of-pocket costs.

4. How much can I save annually with a tax depreciation schedule?

Savings depend on the property’s age, construction cost, and assets. On average, investors save between $5,000 and $10,000 annually.

5. Is it worth preparing a schedule for small properties?

Absolutely. Even small properties can yield significant savings over time, especially if they have updated assets or recent renovations.

6. Do I need to update my depreciation schedule every year?

Not necessarily. However, it’s crucial to update your schedule after any renovations or when acquiring new assets to ensure you’re maximizing deductions.

Final Strategic Insights

A tax depreciation schedule is an indispensable tool for property investors seeking to enhance their financial outcomes. By claiming every eligible deduction, optimizing claim timing, and ensuring ATO compliance, you can significantly reduce ownership costs while improving cash flow.

Whether you’re managing a single property or an extensive portfolio, a professionally prepared schedule ensures long-term financial success and compliance. Embrace technology and expert guidance to unlock your property’s full potential.