Deciding between building vs buying a house in Australia is an important choice for homebuyers. Both options come with their own set of advantages and challenges, influenced by factors such as cost, timeline, location, and personal preferences.

This guide aims to provide a comprehensive comparison of “building vs buying a house in Australia,” exploring key considerations like land and construction costs, property market trends, government incentives, and state-specific regulations. By understanding these factors, you can make an informed decision that aligns with your financial goals and lifestyle needs.

Factors Affecting Building vs Buying Australia

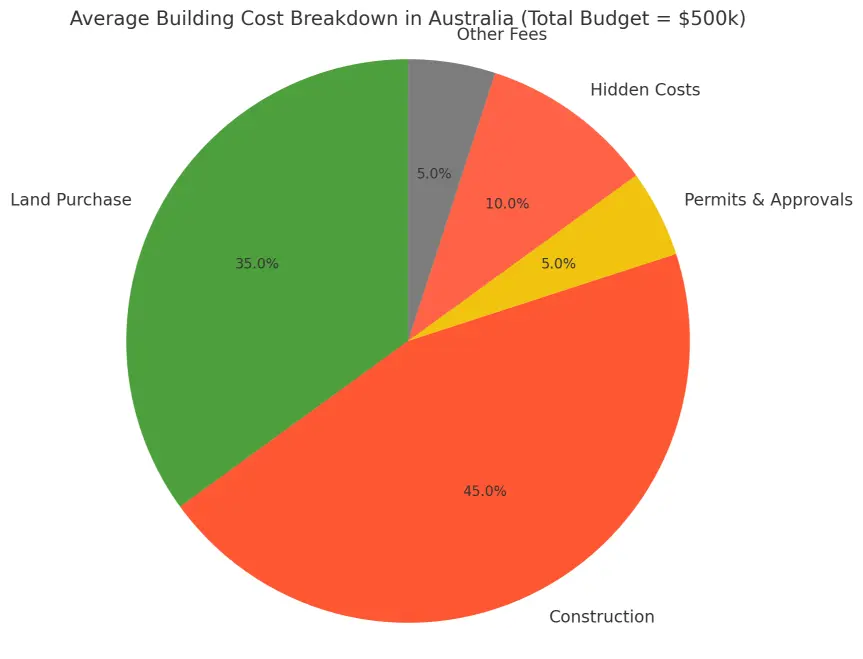

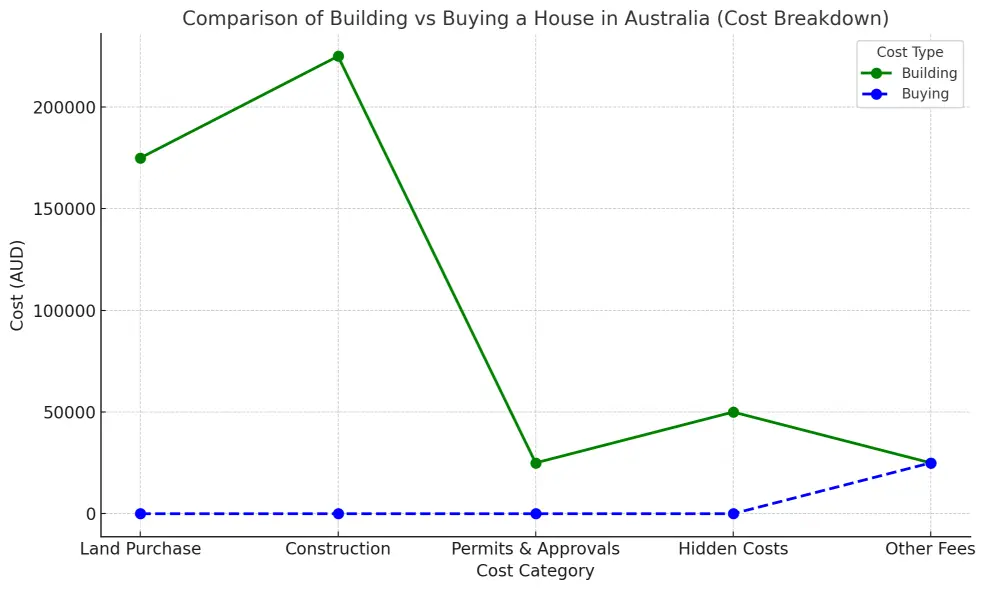

Understanding the costs of building vs buying a house in Australia is essential for making an informed decision, as land and construction expenses vary significantly. Building a house involves various expenses, including land purchase, construction, and approvals, which can significantly influence your overall budget.

Land Costs When Choosing to Build or Buy in Australia

Choosing between building or buying in Australia also depends on hidden costs like soil testing or site preparation. The cost of land significantly impacts the overall expense of building a house in Australia. Key factors include:

- Location: Urban areas like Sydney and Melbourne have higher land prices compared to regional towns due to demand and limited availability. Coastal locations often come at a premium.

- Land Availability: Finding suitable land in metropolitan areas can be challenging, while regional areas tend to have more affordable options but may lack certain amenities. Land availability can affect both your budget and your timeline when choosing to build. For a comprehensive guide on estimating construction costs effectively, read more here.

For instance, land prices in Sydney’s outer suburbs ranged from $1,200 to $2,500 per square metre in recent years, reflecting the high demand for urban land.

Construction Costs to Build a House in Australia

Building costs encompass several components:

- Materials: Costs of timber, bricks, steel, and other building materials fluctuate due to supply chain dynamics and local demand.

- Labour: Labour expenses vary significantly between states, with metropolitan areas often attracting higher rates due to competition for skilled tradespeople.

- Additional Costs: Expenses such as site preparation, utility connections, and landscaping typically add between $15,000 and $40,000 to the total budget.

Permits and Approvals for Building vs Buying Australia

Obtaining necessary permits and approvals is a critical step in the building process. These approvals ensure that your construction complies with local regulations and zoning requirements.

- Typical Costs: Building permits and zoning approvals can range from $5,000 to $15,000, depending on the project size and state regulations.

- Processing Time: Approval times vary by state but typically take several weeks to months.

Hidden Costs of Building a House in Australia

Building a home can come with unexpected expenses that may strain your budget.

- Examples: Soil testing, additional foundation work, and site levelling.

- Recommendation: It’s advisable to budget an extra 10-20% of your total cost to accommodate unexpected issues.

Key Considerations for Building vs Buying Australia

For many, understanding the financial implications of building vs buying a house in Australia starts with property prices, stamp duty, and moving expenses. Buying a house involves a range of financial considerations beyond the property price, including stamp duty, moving expenses, and market trends, all of which can significantly impact your budget.

Property Prices When Buying in Australia

Property prices vary significantly across Australia based on demand, location, and availability:

- High-Demand Areas: Capital cities like Sydney and Melbourne consistently have higher property prices, often exceeding $1 million due to limited housing supply and strong demand.

- Regional Options: Regional areas and smaller towns offer more affordable housing, with median property prices ranging from $400,000 to $700,000.

Understanding market trends in your preferred location is critical to finding the best value for your investment.

Stamp Duty Costs for Buying vs Building in Australia

The decision to build or buy a house in Australia may depend on the impact of stamp duty exemptions for first-home buyers Stamp duty is a mandatory tax paid during property transactions, and it differs across Australian states and territories:

- Calculation: It’s typically based on the property’s value, with exemptions or discounts available for first-home buyers in some states.

- Examples: In NSW, first-home buyers are exempt from stamp duty for properties valued up to $800,000, while in VIC, the threshold is $600,000 for full exemptions.

Moving Costs for Buying a Home in Australia

Relocating to a new home incurs additional expenses, which should not be overlooked:

- Examples: Hiring professional removalists, utility connection fees, and cleaning services.

- Cost Range: Moving costs can range from $1,000 to $5,000, depending on the distance and volume of belongings.

State-Specific Considerations

Building and buying costs vary significantly across Australian states due to differences in land prices, labour costs, and local regulations. Understanding these state-specific factors is essential for making an informed decision.

New South Wales (NSW)

- Building Costs: High demand for land and labour in Sydney makes building in NSW one of the most expensive in Australia.

- Buying Costs: Median house prices in Sydney frequently exceed $1 million, driven by limited housing supply and high demand.

- Regulations: BASIX (Building Sustainability Index) requirements add to construction costs but promote energy and water efficiency.

Victoria (VIC)

- Building Costs: Melbourne’s building costs are moderate but can increase in bushfire-prone areas due to stringent building codes.

- Buying Costs: Median property prices in Melbourne are generally lower than Sydney but remain high compared to regional Victoria.

- Regulations: Properties in bushfire-prone zones require additional safety features, such as bushfire shutters and ember guards.

Queensland (QLD)

- Building Costs: Regional Queensland offers relatively low building costs, but cyclone-resistant building standards in northern areas may increase expenses.

- Buying Costs: Brisbane’s housing market is more affordable than Sydney or Melbourne, with median property prices often below $800,000.

- Regulations: Cyclone-prone regions require compliance with wind-resistance standards under the National Construction Code (NCC).

South Australia (SA)

- Building Costs: Adelaide is one of the most affordable cities for building a home, with competitive labour and material costs.

- Buying Costs: Median property prices in Adelaide are lower than in most other capitals, making it a cost-effective option for buyers.

- Regulations: Building codes are similar to other states, with a focus on energy efficiency.

Western Australia (WA)

- Building Costs: Perth offers reasonable building costs, but regional WA may see higher costs due to transportation and labour shortages.

- Buying Costs: Median house prices in Perth are among the most affordable of all capital cities.

- Regulations: Regional areas may have specific construction requirements for remote or environmentally sensitive zones.

Government Incentives

The Australian government provides various grants and concessions to support homebuyers, especially first-home buyers and those building new homes. Understanding these incentives can significantly reduce costs and influence your decision to build or buy.

First Home Owner Grants (FHOG)

Each state and territory offers grants to eligible first-home buyers. These grants vary in value and eligibility criteria:

- New South Wales (NSW): $10,000 for building or buying a new home valued up to $750,000.

- Victoria (VIC): Up to $20,000 for new homes in regional areas valued up to $750,000.

- Queensland (QLD): $15,000 for new homes valued less than $750,000.

- South Australia (SA): $15,000 for new homes with no maximum property value cap.

- Western Australia (WA): $10,000 for new homes, with additional regional bonuses in specific areas.

Stamp Duty Concessions

Stamp duty is a significant cost for homebuyers, but many states offer exemptions or discounts for eligible buyers:

- NSW: First-home buyers are exempt from stamp duty on properties up to $800,000, with concessions available for homes valued up to $1 million.

- VIC: Full exemptions for properties under $600,000 and concessions for properties valued up to $750,000.

- QLD: Concessions for first-home buyers purchasing homes up to $550,000.

Understanding government grants and concessions can significantly reduce your costs. Learn more about industry changes.

Homebuilder Grant (Historical Program)

The federal government’s HomeBuilder grant provided $25,000 for eligible contracts signed between June 2020 and March 2021. While this program has ended, similar initiatives may emerge in the future.

Other Local Incentives

Some local councils offer incentives, such as reduced fees for sustainable building practices or infrastructure subsidies for new developments.

Eligibility and Application Process

- Documentation: Applicants typically need proof of income, citizenship, and property value.

- Application: These grants are administered by state revenue offices, with detailed criteria available on their websites.

Pros and Cons of Building a House in Australia

Building a house offers unparalleled customisation and modern features but comes with potential challenges. For those seeking a comprehensive understanding of this journey, Buying a Home in Australia: A Step-by-Step Guide provides crucial insights into navigating home construction decisions. This section explores the key advantages and disadvantages of building your own home.

Pros

- Customisation

- Design your home to suit your lifestyle, preferences, and future needs.

- Options to include energy-efficient technologies and smart home systems.

- Design your home to suit your lifestyle, preferences, and future needs.

- Energy Efficiency

- New homes are built to modern standards, meeting stricter energy efficiency and sustainability requirements.

- Lower utility bills over time due to efficient insulation, lighting, and appliances.

- New homes are built to modern standards, meeting stricter energy efficiency and sustainability requirements.

- Choice of Location

- Build in a location of your choosing, including growth areas with future value potential.

- Ideal for securing land in developing suburbs or regional hubs.

- Build in a location of your choosing, including growth areas with future value potential.

- Building Equity

- Custom builds often provide an opportunity to increase property value upon completion.

- The home reflects your personal style, making it more appealing in the resale market.

- Custom builds often provide an opportunity to increase property value upon completion.

Cons

- Cost Overruns

- Unforeseen expenses like site preparation, material price fluctuations, and construction delays can strain your budget.

- Need for a contingency fund of at least 10-20% of the estimated cost.

- Unforeseen expenses like site preparation, material price fluctuations, and construction delays can strain your budget.

- Time Delays

- The building process, including approvals and construction, typically takes 6-12 months or longer.

- Delays due to weather, material shortages, or labour issues can extend timelines.

- The building process, including approvals and construction, typically takes 6-12 months or longer.

- Stress

- Managing a construction project, even with professional help, can be overwhelming.

- Decision-making at every stage, from design to completion, can be time-consuming.

- Managing a construction project, even with professional help, can be overwhelming.

- Unforeseen Issues

- Challenges like poor soil quality, council zoning restrictions, or unexpected site conditions may arise.

- Requires flexibility and problem-solving during construction.

- Challenges like poor soil quality, council zoning restrictions, or unexpected site conditions may arise.

Pros and Cons of Buying

Buying a house is a quicker and more straightforward option compared to building, but it comes with limitations. This section explores the key advantages and disadvantages of purchasing an existing property.

Pros

- Immediate Availability

- Move into your new home shortly after purchase, typically within 1-3 months after settlement.

- No need to wait for construction or approvals.

- Move into your new home shortly after purchase, typically within 1-3 months after settlement.

- Established Community

- Enjoy access to mature neighborhoods with existing infrastructure like schools, shops, and transport.

- Often surrounded by fully developed amenities and public services.

- Enjoy access to mature neighborhoods with existing infrastructure like schools, shops, and transport.

- Potential for Immediate Rental Income

- If buying as an investment, an existing property can generate rental income right away.

- Established properties may already have tenant appeal due to location or existing features.

- If buying as an investment, an existing property can generate rental income right away.

- Lower Stress

- The buying process involves fewer decisions compared to building, making it less time-consuming.

- You avoid managing construction timelines, permits, or customisation choices.

- The buying process involves fewer decisions compared to building, making it less time-consuming.

Cons

- Limited Customisation

- You may need to compromise on layout, design, and features, as the property is pre-built.

- Renovations or updates may be required to meet your preferences.

- You may need to compromise on layout, design, and features, as the property is pre-built.

- Potential Hidden Defects

- Older homes may have structural or maintenance issues that aren’t immediately apparent.

- Costs for repairs, pest treatments, or upgrades can add up.

- Older homes may have structural or maintenance issues that aren’t immediately apparent.

- Reliance on Market Conditions

- Prices for established properties in high-demand areas can be significantly inflated.

- The competition in auctions or private sales can lead to overpaying.

- Prices for established properties in high-demand areas can be significantly inflated.

- Age of the Property

- Older homes may not meet modern energy efficiency or sustainability standards.

- Higher utility bills and ongoing maintenance costs are common for older properties.

- Older homes may not meet modern energy efficiency or sustainability standards.

The Bottom Line

Whether you choose building or buying a house in Australia, planning and professional advice are key. Each option comes with its own set of advantages and challenges, and understanding these can help you make an informed choice.

- Building a House: Offers the freedom to customise and include modern, energy-efficient features but requires time, careful planning, and a contingency fund for unexpected costs.

- Buying a House: Provides convenience, immediate availability, and access to established neighborhoods but may involve compromises in design and potential hidden maintenance expenses.

Thorough research and professional advice are key to making the right decision. Consult with experts such as quantity surveyors, builders, and real estate agents to understand the financial implications and practicalities of your choice.

Contact Matrix Estimating today for professional quantity surveying and cost estimating services. We can help you manage your project’s costs and maximise value, whether you choose to build or buy.

FAQs About Building vs. Buying a House in Australia

1. Is it cheaper to build or buy a house in Australia?

It depends on the location. Building is often cheaper in regional areas with lower land prices, but in urban areas, buying an existing home may be more cost-effective due to high construction and land costs.

2. How long does it take to build a house in Australia?

On average, building a house takes 6 to 12 months. This timeline can vary depending on factors like the complexity of the design, weather conditions, and construction delays.

3. Are there government grants for building a house in Australia?

Yes, most states offer first-home buyer grants and stamp duty concessions for building new homes. The eligibility criteria and grant amounts vary by state.

4. What are the hidden costs of buying a house?

Hidden costs can include stamp duty, legal fees, property inspections, moving expenses, and potential maintenance or renovation costs for older properties.

5. Can I customise a pre-built house?

Customisation is limited but possible through renovations or updates. You can modify elements like paint, fixtures, or landscaping to suit your preferences.

6. Are there risks involved in building a house?

Yes, risks include cost overruns, delays due to weather or material shortages, and potential issues with contractors or permits. A contingency budget is essential to manage unforeseen expenses.

7. Which is faster: building or buying a house?

Buying is typically faster. The settlement process for an existing home takes 1 to 3 months, whereas building a home can take 6 to 12 months or longer.

8. How do I decide between building and buying?

Consider your budget, timeline, location preferences, and lifestyle needs. Building is ideal for customisation, while buying offers immediate occupancy and convenience.